|

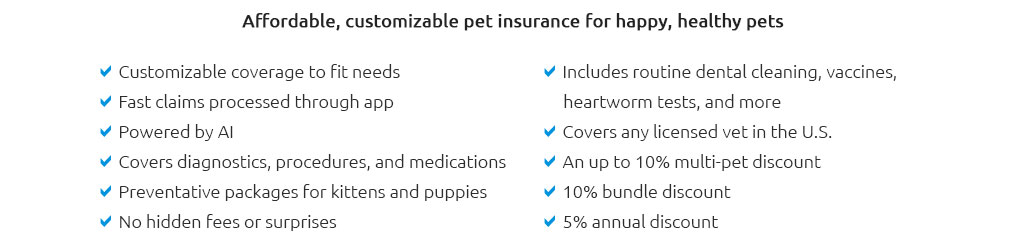

pet health insurance utah guide to smarter coverage and calmer vet billsWhy Utah-specific context mattersHigh elevation, hot summers, icy winters, and trail-heavy weekends make Utah pets resilient - and occasionally accident-prone. Think cactus spines, foxtails, sprains on slick sidewalks, or altitude-related fatigue that masks an emerging issue. Smart coverage gives you result: predictable out-of-pocket costs, faster green-lights for treatment, and fewer tough tradeoffs at the clinic. How plans generally workMost policies reimburse you for unexpected accidents and illnesses after you pay the vet. You choose financial settings up front; they control both premiums and future claim results. What's typically covered- Accidents: bites, cuts, broken bones, foreign body ingestion.

- Illnesses: GI upsets, infections, cancer, chronic conditions (if not pre-existing).

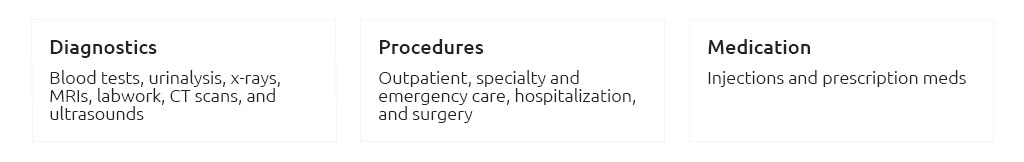

- Diagnostics: x-ray, ultrasound, lab work.

- Treatments: surgery, hospitalization, prescription meds.

- Emergency and specialty care; some policies include rehab or acupuncture.

Common exclusions (read carefully)- Pre-existing conditions and anything during waiting periods.

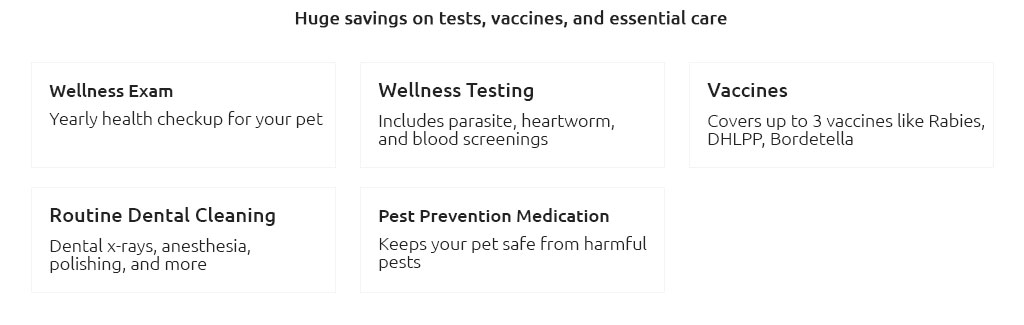

- Routine care unless you add a wellness rider.

- Breeding-related issues, elective procedures, and (sometimes) exam fees.

- Dental illness unless explicitly included; accident-only dental is more common.

Your control levers- Deductible (per-year or per-incident): higher means lower premium; lower means faster reimbursements.

- Reimbursement (70 - 90% is common): higher boosts payback, nudges premium upward.

- Annual limit: $5k - unlimited; larger limits shield big emergencies, cost a bit more.

Dial these to fit your risk comfort. You'll feel the difference at checkout - quicker "yes" to care, calmer budget afterward. Step-by-step to a good fit in Utah- Profile your pet: age, breed tendencies, activity level (Wasatch hikes or couch naps?).

- Ask your vet for a ballpark on local emergency and specialty costs.

- Decide priorities: low premium vs. high protection; note must-haves (e.g., exam fees, rehab).

- Gather 2 - 3 quotes with the same settings (deductible/reimbursement/limit) for apples-to-apples.

- Read a sample policy; check waiting periods, bilateral condition rules, dental language.

- Test support: how you submit claims, average pay times, direct pay options (rare, but helpful).

- Enroll before issues arise to avoid pre-existing exclusions.

- Set a claim routine: save invoices, take clear photos, submit the same day.

- Re-evaluate at renewal; adjust levers if your bills or income change.

A quick, real-world Utah momentAfter a Sunday walk near Millcreek Canyon, a lab snagged a dewclaw. The owner photographed the itemized invoice in the parking lot, submitted through the app, and saw reimbursement hit their account four business days later - usually that fast, though not always. Cost snapshot and simple mathPremiums vary by pet and ZIP, but in Utah they're often a notch lower than big coastal cities. Roughly: dogs $25 - $60/month, cats $12 - $35/month, depending on age and settings. - Example 1: $1,200 injury bill, $250 annual deductible, 80% reimbursement, $10k limit. You pay $250 deductible + 20% of the remaining $950 = $250 + $190 = $440. Reimbursement: $760.

- Example 2: $600 porcupine quill removal, $500 deductible, 90% reimbursement. You pay $500 + 10% of $100 = $510. Reimbursement: $90. A lower deductible would shine on mid-sized bills.

Claims and reimbursements, without surprises- Pay the vet and collect a detailed invoice and medical notes.

- Submit via app/portal the same day; attach photos of records.

- Track status; set direct deposit for speed.

Emergency clinics seldom take direct payment from insurers, so keep a small buffer fund; insurance then backfills your account, often quickly. Fine-tune for Utah life- Active outdoors? Look for strong accident and ER coverage; rehab helps with trail sprains.

- Desert and foothill exposure: consider snakebite-ready limits; ask your vet about regional risks.

- Winter salt and ice: paw injuries and slips happen - check if exam fees are covered.

Avoid these easy mistakes- Choosing a very low annual limit that won't cover a single specialist stay.

- Overlooking waiting periods before that first hike-heavy weekend.

- Missing bilateral rules (e.g., one knee today, the other knee tomorrow).

- Assuming dental illness is included; verify.

Fast checklist before you buy- Confirm accident and illness waiting periods.

- Note deductible type and amount.

- Ask if exam fees and prescription meds are covered.

- Check rehab/alt therapies if you're active outdoors.

- Verify how pre-existing conditions are defined and re-evaluated.

The result you're aiming forClear costs, fast green-lights for care, and policy settings you control. Not perfect certainty, but far fewer expensive surprises - so you can say "yes" to treatment and move on with your day.

|

|